Disney stock is down 24% since February and is approaching 52-week lows. The company’s coming off a fiscal Q earnings report that saw a net loss of $460 million, or 25 cents per share. The company’s business has generated wide profit margins and solid growth over the years.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information. While we have a limited line of sight into the next year, there’s no doubt that a lot of pessimism has been priced into the sector, making for some potentially compelling investment opportunities. Consumer discretionary includes home electronics, restaurants, travel companies and even automakers. Here are some frequently asked questions about investing in Consumer Discretionary stocks.

If you’re afraid of losing your job in a recession, it’s easy to postpone that vacation or buy fewer pairs of new shoes before you stop buying groceries and shampoo. When choosing portfolio investments, you should learn more about consumer discretionary stocks. The consumer discretionary meaning refers to companies that tend to be sensitive to interest rates and economic conditions. Unlike consumer staples stocks, which are companies that make products people need regardless of their preferences or economic well being, there is highly elastic demand for consumer discretionary goods. That means that more expensive goods are easily replaced by less expensive ones—or simply don’t need to be purchased at all. ETFs provide a low-cost option for investors to diversify and access a wide range of investment themes, including consumer discretionary stocks.

- These are items that consumers can usually live without and don’t necessarily need in their day-to-day lives.

- McDonald’s is a perfect example of a consumer discretionary stock.

- We also offer sector mutual funds and sector ETFs from other leading asset managers.

- The consumer discretionary sector plays a significant role in the overall health of the domestic economy.

- Since then, HD has grown to more than 2,200 stores in three countries.

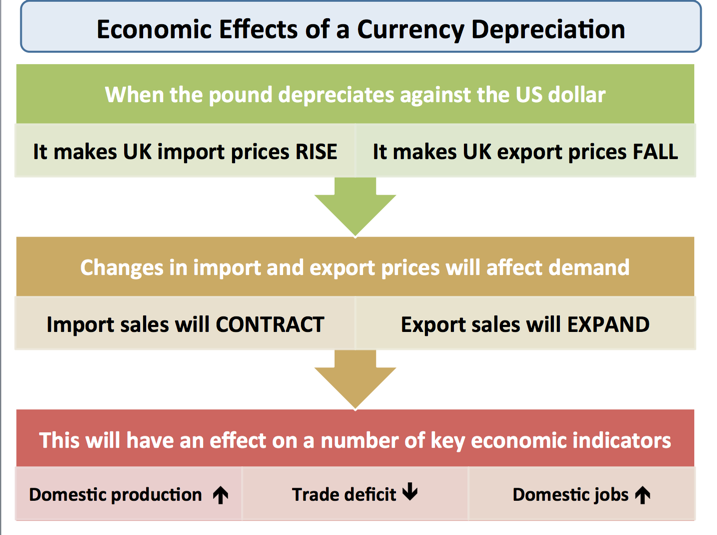

There are several economic indicators that help economists to determine the state of an economy. These indicators are also important for predicting trends for the consumer discretionary and consumer staples sectors. A growing economy—expansion to peak—is usually characterized by stronger earnings for businesses and consumers. A contracting economy—contraction to trough—generally has the opposite effect. Economic cycles have a big influence on earnings power and consumer spending in an economy.

What is meant by consumer discretionary?

Wall Street analysts refer to such businesses as consumer discretionary. Consumer confidence plays a central role in the consumer discretionary sector. The University of Michigan’s consumer sentiment index provides a gauge of how optimistic U.S. consumers feel about the state of the U.S. economy and their expected spending habits. The consumer discretionary sector is made up of businesses that sell non-essential goods and services.

This is often cheaper — both in dollars and in research time — than buying individual stocks. If you learn to read stock charts and understand basic patterns and trend lines, you can easily spot consumer discretionary stocks rising in heavy volume. According to data compiled by the Bureau of Economic Analysis, consumer spending accounts for about 70% of GDP. The consumer discretionary sector plays a significant role in the overall health of the domestic economy. Consumer discretionary stocks tend to perform well during economic expansions, making them attractive to investors who foresee an uptick in spending. However, these companies can be more sensitive to changes in the economy, especially if people hold back or postpone unnecessary purchases.

Retailers and manufacturers of consumer discretionary goods are particularly exposed to problems from supply chain disruptions. Manufacturing of complicated durables and automobiles depend upon sprawling networks of suppliers, for instance, making them vulnerable to supply chain disruptions. Tempur Sealy International (TPX) is one example of a household durables company. Many companies within the industry do not own their real estate properties, but they act as operating companies and sign lease agreements. Also, many hotels and restaurants pursue franchise business models rather than owning and operating restaurants themselves.

In a passively managed ETF, a fund manager buys a basket of consumer discretionary companies with a broad index. Alternatively, fund managers can buy or sell stocks in a sector at their discretion with actively managed funds. The term describes products and services that are desirable for consumers, but not essential to their daily living. In other words, rather than having to buy these products because they are necessities, they have the freedom to decide—the discretion—to purchase them, or not. Consumer discretionary purchasing usually increases when consumers have more money to spend.

Consumer Discretionary¶

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial working capital turnover ratio can be determined by situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal. Examples of specialty retail companies include The Home Depot (HD) and Best Buy (BBY). The multiline retail industry includes operators of department stores and other stores that sell general merchandise, such as hypermarkets and large-scale supercenters.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Why invest in the consumer discretionary sector?

Consumer discretionary stocks tend to rise when consumers are optimistic or have more money in their pockets due to higher wages. Conversely, they fall when consumers are concerned about a possible recession or when inflation or interest rates are high. For those reasons, broader economic conditions and consumer sentiment generally determine the sector’s direction. In an economic downturn, it’s easy to spot the difference between consumer staples vs consumer discretionary.

When the economy expands, companies that sell consumer discretionary goods and services tend to see a booming business. As the economy begins to recover, consumer discretionary companies again show growth. In a poor economy, consumers are more likely to forego the purchase of consumer discretionary goods in favor of adding to their savings. The financial performance of companies that produce consumer discretionary goods is generally tied to the state of the economy as well. When measured as a sector of the economy, the performance of consumer discretionary companies can be an indicator of future economic conditions and stock market performance.

Consumer Discretionary Stocks With Whale Alerts In Today’s Session

It’s relatively easy to predict where trends for the consumer discretionary sector may go. Toyota Motors is the top-selling automaker in the U.S. market, surpassing rival GM’s sales in 2021. Founded in 1933 as a subsidiary of Toyota Automatic Loom Works, the company released its first production car in 1936. It suspended production of passenger cars during World War II to focus on trucks and didn’t resume production of passenger vehicles until 1947.

Director At This Consumer Discretionary Company Sells $240K of Stock – G-III Apparel Group (NASDAQ:GIII) – Benzinga

Director At This Consumer Discretionary Company Sells $240K of Stock – G-III Apparel Group (NASDAQ:GIII).

Posted: Thu, 14 Sep 2023 15:03:01 GMT [source]

Investors also like McDonald’s for its consistent dividend payments. It has increased payments to shareholders each year since the mid-1970s, making the company a Dividend Kings. With a payout ratio of around 60% of earnings, McDonald’s can comfortably maintain its dividend. Get our industry-leading investment analysis, and put our research to work. The retailing industry group might sound self-explanatory — but it’s a bit harder to define than you might think. Real gross domestic product rose 1.1% in the first quarter of 2023, according to the Bureau of Economic Analysis’ advance estimate, after rising 2.6% in the fourth quarter of 2022.

ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities. But for now, the company’s prospects and the https://1investing.in/ diluted share value pushed the stock price below $1 per share. WKHS may need to look at a stock split or other financial tricks at some point to get the share price back over Nasdaq compliance rules.

Headquartered in Aurora, Ontario, Canada, the company designs and manufactures automotive parts and supplies. Now let’s take a look at some of the key industries that make up this sector.

Understanding consumer discretionary stocks

Although TJX took a hit during the pandemic like other discretionary retailers, the company bounced back in 2021. While apparel and home goods retailers are facing headwinds in 2022 as consumer spending shifts back to services, TJX still expects modest comparable sales growth for the year. The company has increased year-to-date profits at a time when many of its peers are struggling with bloated inventory levels. Each economic cycle influences consumer spending and labor earnings. Investors can look at the overall economy to determine whether they want to invest in consumer discretionaries or not.

Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first.